Human behaviour is a funny thing. There have been countless articles about behavioural finance and its influence over why humans do certain things at certain times. When it comes to human behaviour, investing is no different.

With that in mind, let’s consider the implications of trying to ‘time the market’ with regards to managing an investment portfolio. We would all like a crystal ball that tells us when to buy and, more importantly, when to sell (especially given the market gyrations over the last 12mths). There is empirical evidence suggesting long-term investors benefit from staying the course, and, where possible, buying the dips! This is of course easier said than done when one may be influenced by headlines during any material market downturn. In this article we’ll look at staying the course and the implications for attempting to time the markets, potentially missing out on the ‘good days’.

Extreme market volatility (large moves up and down) tends to rattle investors. The media also plays a roll, meddling with the human psyche by often broadcasting alarmist headlines (“Investor Anxiety Hits a Fever Pitch After Silicon Valley Bank Collapse”, WSJ March 14, 2023). With the rise of algorithmic trading, in times of elevated volatility, intra-day market moves can be eye watering to observe and can rattle the most seasoned investor. One only needs to dig a little deeper into the intra-day movements of the bond market for example in the days preceding the Silicon Valley Bank collapse this year to fully appreciate how volatile the plumbing of the financial markets can be from time to time (SVB collapse unleashes Treasury volatility, whiplashing investors, Reuters 14th March 2023).

In such an environment, it is easy to understand how an investor could be lulled into thinking the best course of action is to “sell everything”. This is where liquidity also plays a part for long-term investors. An allocation to cash as part of your asset allocation provides liquidity and a buffer. This allows an investor to avoid ‘having to sell’ at market lows if cash is required to fund your lifestyle. We are strong advocates of having enough cash within a portfolio to support expected (and, to a degree, unexpected) expenses, removing the need to sell investments that may have lost value in a market downturn.

Succumbing to market fears and selling at the bottom (or into market weakness) is not always the best choice for a long-term investment portfolio. Often, the most volatile days of a market sell-off are also coupled with the best days in terms of markets moving higher. The compounding effect of not being exposed to that volatility over the long-term adds up. Potentially missing those few solid ‘up’ days (when trying to time the market) can have a lasting impact on your longer-term investment returns. You could miss out on the compounding effect of the market movements over the long-term.

It is very easy to get fixated on shorter term returns (again, human behaviour) however, the more important returns are those seen over the longer term, where the compounding effect of your investments goes to work (think 5, 10 & 15 years). Every additional return that you make over the longer term contributes to the overall performance of your investment portfolio.

While we at Providence are advocates (and practitioners) of a diversified, multi-asset class investment approach, for illustrative purposes consider the following:

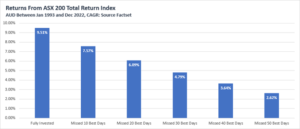

Almost every significant stock market movement of large-scale gains and falls occurs over a handful of trading days each year. Missing these days can have a material impact on overall returns. For example:

- Over the period between January 1993 to December 2022, the annualised return for $10,000 invested in the ASX 200 Index was 9.51% for someone who remained fully invested.

- Missing the 10 best days over that same period reduced that annualised return to 7.75%. Your overall return for missing those 10 best days vs. staying fully invested would have been 20% lower per annum.

- Missing the 30 best days reduced the annualised return further to 4.79%. Your overall return for missing those 30 best days vs. staying fully invested would have been 49% lower per annum.

The chart below provides further detail. Never underestimate the power of compounding returns over the long-term.

And further, if one was to look at the average intra-year declines of the equity market (ASX 200 depicted in the chart below) we can see that it is quite normal to see a significant level of intra-year movement at the index level. Indeed, despite an average intra-year decline to 13.9%, the annual returns of the ASX 200 Index are positive in 20 out of 29 years.

Source: JP Morgan Asset Management

Some notable quotes to leave you with:

“ The individual investor should act consistently as an investor and not as a speculator.” Benjamin Graham

“ Our favourite holding period is forever.” Warren Buffett